The $100+ Monthly Shock

If you have ever tried to buy pet insurance for an English Bulldog, you know exactly what the “Sticker Shock” feels like.

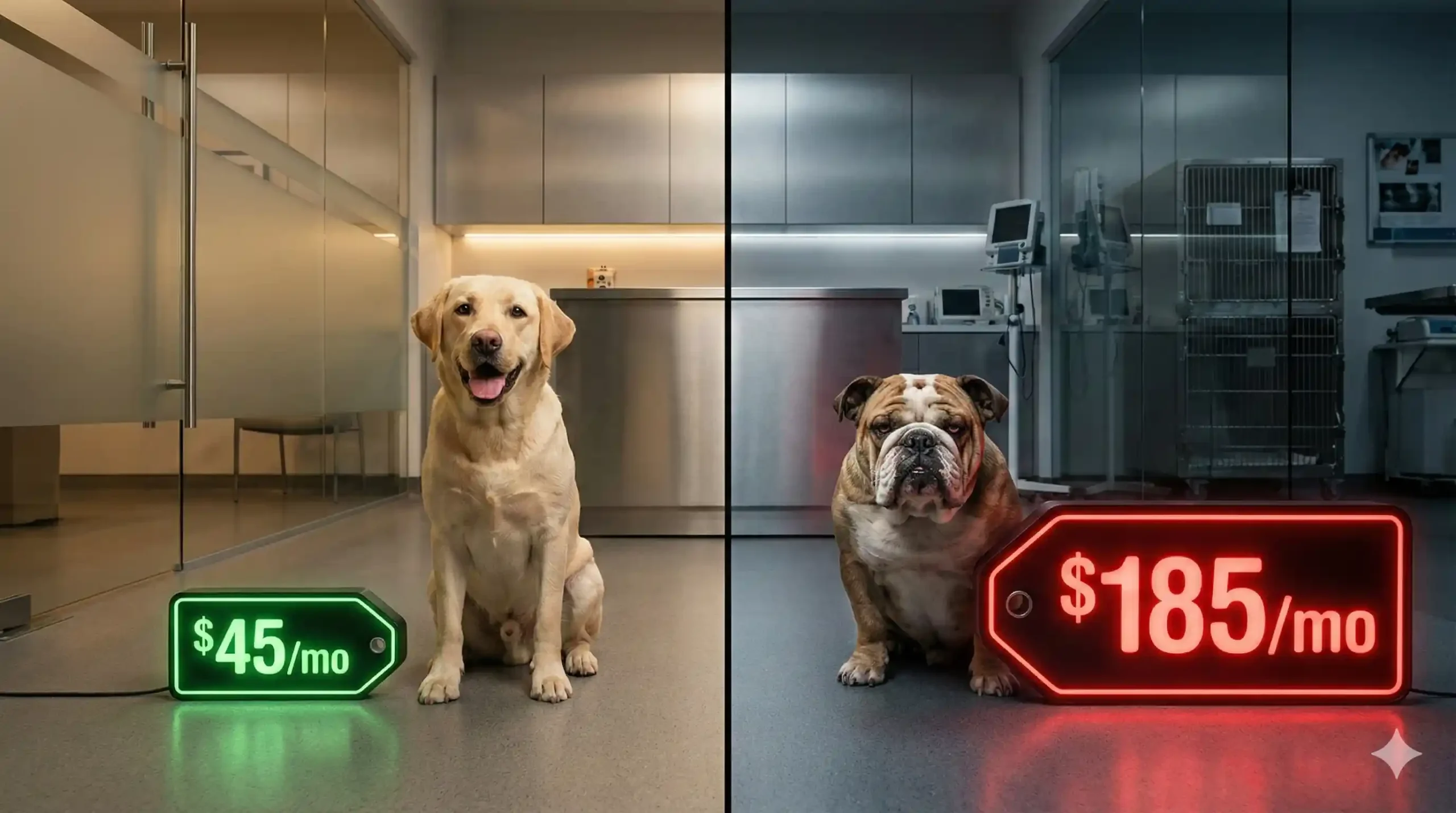

I recently sat down to run a massive data comparison. I requested a quote for a healthy, 8-week-old Labrador Retriever. The monthly premium came back at a very reasonable $45.

Then, using the exact same zip code, the exact same coverage limits, and the exact same insurance company, I ran a quote for an 8-week-old English Bulldog.

The quote? $165 per month.

When I talk to flat-faced dog owners, they always ask the same frustrated question: “Why am I being punished just for the breed I chose?” It feels like discrimination, but to an insurance underwriter, it is just cold, hard statistics. In this guide, I will break down exactly why insurers consider Bulldogs a massive financial liability compared to standard breeds like Labs, and how you can manipulate your policy to lower that painful monthly bill.

The Anatomy of the “Breed Tax”

Insurance companies use sophisticated algorithms to predict how much money a dog will cost them over its lifetime.

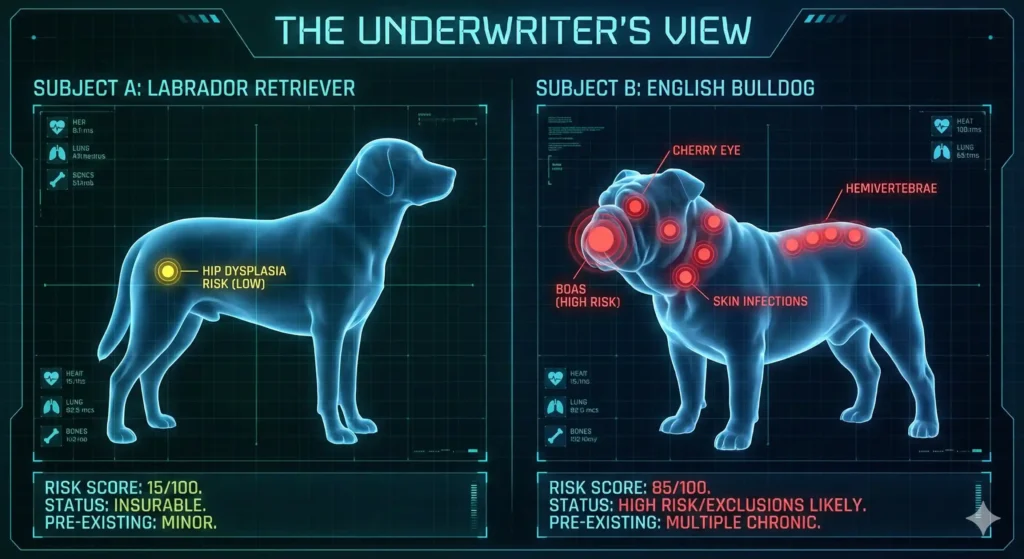

When an underwriter looks at a Labrador Retriever, they see a robust, athletic working dog. Sure, Labs might eat a sock and need an emergency blockage removal, or they might develop joint issues when they are 10 years old. But overall, their risk profile is spread out.

When an underwriter looks at an English or French Bulldog, they see a genetic minefield. The American College of Veterinary Surgeons clearly outlines that the very physical traits that make Bulldogs so cute—their smushed faces, heavy wrinkles, and compact bodies—are actually structural deformities that guarantee expensive medical intervention.

You are not just paying for the possibility of an accident; you are paying for the inevitability of their genetics.

The Data: Lifetime Cost Projections

I built this comparison table based on average 2026 veterinary claim data. This is exactly what the insurance algorithms see when they calculate your premium.

| Risk Category | The Labrador Retriever | The English Bulldog | Estimated Claim Cost |

| Breathing (Airway) | Low Risk (Normal muzzle) | Critical Risk (BOAS) | $3,500 – $6,000 |

| Dermatology (Skin) | Moderate (Seasonal allergies) | High Risk (Skin fold pyoderma) | $500 – $1,200 annually |

| Orthopedic (Joints) | High Risk (Hip Dysplasia late in life) | Extreme Risk (Spinal & Hip deformities) | $4,000 – $8,000 |

| Ophthalmology (Eyes) | Low Risk | High Risk (Cherry Eye, Ulcers) | $1,500 – $3,000 |

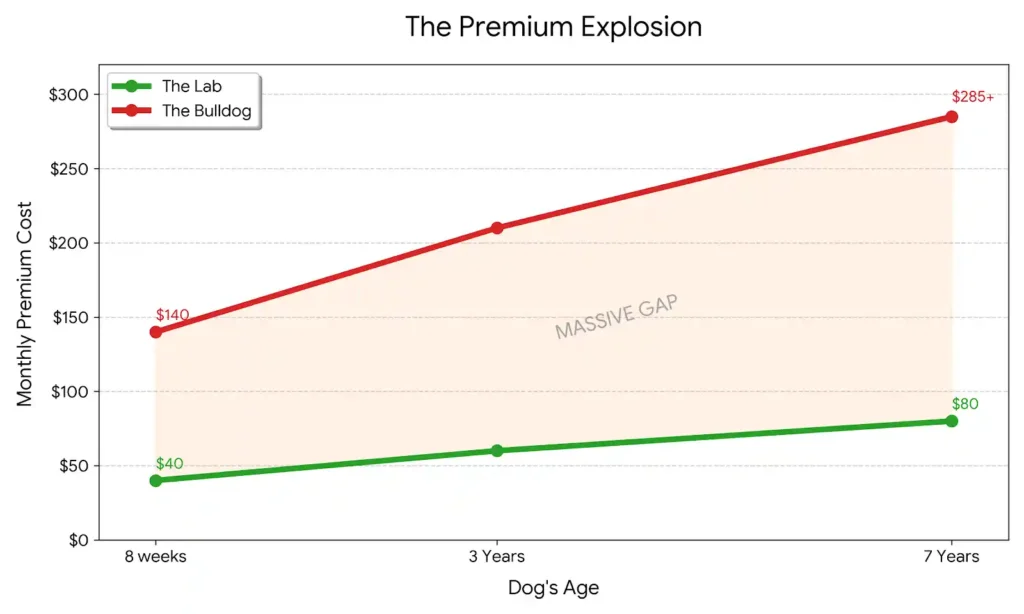

| Average Monthly Premium | $40 – $60 | **$120 – $250+** | The Bulldog Penalty |

The “Big Three” Claims That Inflate Your Premium

If you want to know exactly where that extra $100 a month is going, it is split across three major medical categories that insurers know they will eventually have to pay for.

1. The $6,000 BOAS Timebomb

While a Lab cools down by panting normally, a Bulldog’s flat face means they are chronically deprived of oxygen. The algorithms know there is a massive statistical probability that your Bulldog will eventually need Brachycephalic Obstructive Airway Syndrome (BOAS) surgery. Since this surgery requires specialists and intensive oxygen therapy, the insurer bakes this future $6,000 payout directly into your monthly premium from Day 1.

2. The Endless Dermatology Bills

Labradors have a smooth, weather-resistant coat. Bulldogs have deep facial and body wrinkles. These wrinkles trap moisture, yeast, and bacteria. Insurers know that Bulldog owners will be visiting the vet 3 to 4 times a year for medicated shampoos, antibiotics, and cytopoint injections for chronic skin fold dermatitis.

3. The Orthopedic Nightmare

According to the Orthopedic Foundation for Animals (OFA), English Bulldogs have one of the highest rates of hip dysplasia of any breed. Furthermore, their signature “corkscrew” tail is actually a spinal deformity (hemivertebrae) that can lead to severe neurological issues and paralysis. Spinal surgery easily crosses the $8,000 mark.

How to Lower the Bulldog Penalty

You cannot change your dog’s DNA, but you can change how you structure your policy to make it affordable. Here is my exact playbook for insuring a high-risk breed without going broke.

Raise the Deductible to $1,000

If you are paying $200 a month for a standard $250 deductible, you are bleeding cash. By raising your annual deductible to $750 or $1,000, your monthly premium will drop dramatically (often by 30% or more). Use the insurance for massive disasters like airway surgery or spinal issues, not for minor ear infections.

Skip the “Wellness” Add-Ons

Insurers love to upsell you on “Wellness Plans” that cover vaccines and teeth cleaning. Do not buy them for a Bulldog. They increase your monthly premium significantly but cap your payouts. Pay for routine care out of your own pocket so you can afford the highest possible illness coverage.

Lock in the “Puppy Rate”

Because insurers know Bulldogs break down as they age, premiums skyrocket when the dog turns 3 or 4 years old. If you lock in a policy when they are 8 weeks old, you secure the lowest possible base rate, and any conditions they develop will be fully covered rather than dismissed as pre-existing.

Frequently Asked Questions (FAQs)

-

Why is French Bulldog insurance so expensive compared to English Bulldogs?

While English Bulldogs are historically the most expensive, French Bulldogs have caught up. Frenchies are prone to the exact same BOAS issues, but they also have a notoriously high rate of Intervertebral Disc Disease (IVDD), which requires emergency spinal surgery. Insurers price both breeds at the very top of their risk charts.

-

Are there any pet insurance companies that don’t charge more for Bulldogs?

No. Every legitimate pet insurance provider in the US uses breed-specific underwriting. If a company claims they charge the same flat rate for a Bulldog and a mixed-breed rescue, read the fine print—they almost certainly exclude hereditary conditions completely.

-

Does pet insurance cover cherry eye surgery?

Yes, as long as the dog did not show signs of the prolapsed gland (cherry eye) before the policy’s waiting period ended. Because cherry eye is so common in Bulldogs, insurers will check early puppy records meticulously to ensure it isn’t pre-existing before they approve the $1,500 surgical claim.

YMYL & Financial Disclaimer: The information provided on Flat Face Insurance is for educational and consumer advocacy purposes based on my independent research of US veterinary and insurance markets. I am not a licensed veterinarian or a licensed insurance agent. Pet insurance premiums are determined by proprietary algorithms that factor in breed, age, and your specific zip code. Always request a personalized quote and a full sample policy document from the provider before making financial decisions.