The Pre-Existing Nightmare for Bulldogs

When I review pet insurance policies for English and French Bulldogs, I usually end up frustrated.

Bulldogs are incredibly expensive to insure because their genetics make them prone to chronic issues. If you take your 4-month-old Bulldog puppy to the vet for a simple yeast infection in their ear, almost every major insurance company will label “ear infections” as a pre-existing condition. If they need a $3,000 ear canal surgery three years later, your claim will be denied.

But recently, I started digging deep into Spot Pet Insurance.

Spot has been heavily marketing themselves to pet parents of high-risk breeds, and for one very specific reason: they handle pre-existing conditions differently than almost anyone else in the industry. I tore apart their fine print to find out if Spot is actually the lifesaver Bulldog owners have been waiting for, or just another expensive trap.

Here is exactly how Spot works for flat-faced breeds in 2026, and the hidden “clause” you need to take advantage of.

The “180-Day Curable” Lifeline

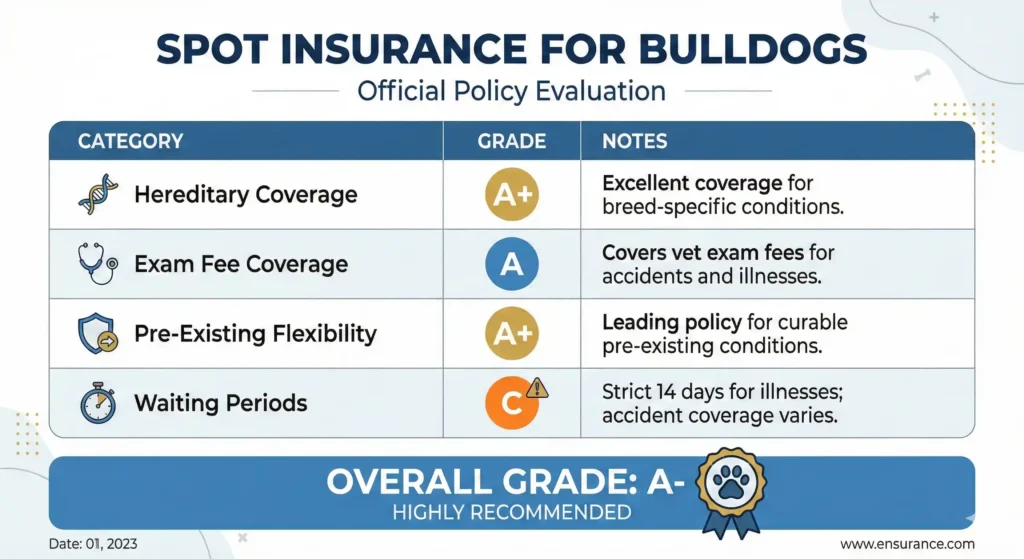

The single biggest reason I frequently recommend Spot to Bulldog owners is their Curable Pre-Existing Condition Clause.

Most budget insurers treat your dog’s medical record as a permanent ban list. If your dog had an allergy, they are banned for allergy coverage for life.

Spot uses a rolling 180-day window. If your Bulldog had a minor issue (like an ear infection, a bout of diarrhea, or a minor respiratory infection) before you bought the policy, Spot will actually cover that condition in the future—provided your dog goes 180 days completely symptom-free and treatment-free.

According to the consumer guidelines published by the American Veterinary Medical Association (AVMA), understanding the difference between “curable” and “incurable” conditions is the most critical step in choosing a policy. Because Bulldogs frequently suffer from minor, curable hiccups in their first year of life, Spot gives you a legal mechanism to “reset” their medical record and get full coverage later.

Note: This does not apply to incurable genetic conditions. If your dog is diagnosed with Hip Dysplasia or severe BOAS before enrollment, it is permanently excluded.

Customization: Hacking the “Bulldog Premium”

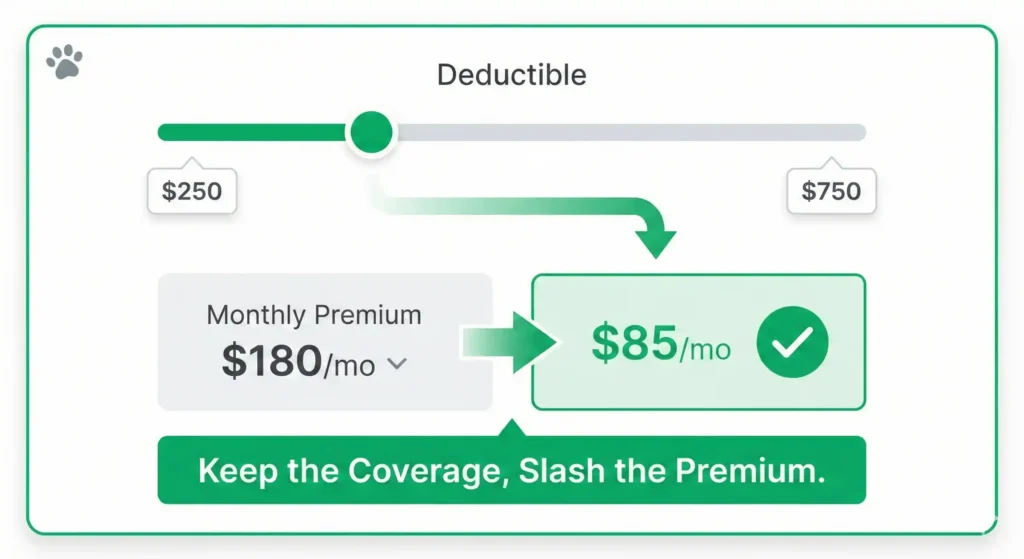

Because Bulldogs are considered a high-risk breed by veterinary underwriters, their monthly premiums are notoriously high. If you want a 90% reimbursement rate with a low $250 deductible, you might be quoted $150 to $200 a month.

However, Spot has one of the most flexible customization engines in the industry. You can aggressively manipulate your policy to make it affordable.

Here is a data breakdown of how I “hack” the Spot system to keep coverage high while slashing the monthly premium:

| Policy Variable | The “Standard” Plan (Too Expensive) | The “Bulldog Hack” Plan (Smart) | Why I Do This |

| Annual Limit | Unlimited | $10,000 | Bulldogs rarely exceed $10k in a single year unless they have multiple catastrophic surgeries. |

| Reimbursement | 90% | 80% | Dropping this by 10% drastically lowers your monthly bill. |

| Annual Deductible | $250 | $750 | You take on minor vet bills (like eye drops), but you are fully protected against a $6,000 airway surgery. |

| Exam Fees | Not Covered | Covered (Included in base) | Spot includes the $100+ vet exam fee in their base plan, which many rivals charge extra for. |

Where Spot Falls Short (The Bad News)

As much as I love their curable clause, Spot is not perfect. If you are insuring a Brachycephalic breed, you need to be aware of their strict waiting periods.

Spot enforces a 14-day waiting period for all accidents and illnesses.

If your Frenchie overheats and starts choking on Day 12 of your policy, the resulting emergency vet visit and any future Brachycephalic Syndrome surgical interventions will be permanently flagged as pre-existing. Unlike some competitors who offer “Exam Day Codes” to bypass the wait, Spot forces you to ride out the full 14 days. You must keep your Bulldog in an absolute bubble during those first two weeks.

Additionally, as your Bulldog ages past 5 or 6 years old, Spot’s premiums can increase significantly upon annual renewal. This is standard across the industry, but it can cause severe sticker shock for older dogs.

The Final Verdict: Is Spot Worth It?

If you are bringing home an 8-week-old Bulldog puppy, Spot is easily one of the top three providers I recommend in the United States.

Because they automatically include exam fees, cover microchip implantation, and explicitly cover hereditary and congenital conditions (like BOAS and Cherry Eye), they check every major box for a flat-faced breed. But their true superpower is the 180-day curable clause. It provides a massive safety net for owners whose dogs had a minor rough patch as a puppy.

If you can afford to raise the deductible to keep your monthly costs down, Spot provides incredibly robust financial armor against the inevitable veterinary bills your Bulldog will rack up.

Frequently Asked Questions (FAQs)

-

Does Spot Pet Insurance cover BOAS surgery?

Yes. Spot covers Brachycephalic Obstructive Airway Syndrome (BOAS) surgery as long as the dog did not show any clinical signs of respiratory distress (like severe snoring or sleep apnea) before the 14-day waiting period expired. It is classified under their standard hereditary/congenital coverage.

-

Does Spot require medical records before enrolling?

You do not need to submit records just to buy the policy and start the 14-day clock. However, when you file your very first claim, Spot will require you to submit your dog’s complete medical history from every vet they have ever visited to verify that the condition wasn’t pre-existing.

-

Is Spot’s preventative care add-on worth it for a Bulldog?

Generally, no. Spot offers “Gold” and “Platinum” preventative care riders that cover vaccines, dental cleanings, and flea meds. However, the math rarely works in your favor. You often pay more in monthly add-on fees than you get back in routine care limits. I recommend putting that money into a savings account and only paying Spot for major illness/accident coverage.

YMYL & Financial Disclaimer: The information provided on Flat Face Insurance is for educational and consumer advocacy purposes based on my independent review of 2026 US pet insurance policy documents. I am not a licensed veterinarian, nor am I an underwriter for Spot Pet Insurance. Insurance terms, waiting periods, and premiums vary significantly by state, zip code, and your pet’s age. Always request a full sample policy document from the provider and read the “Exclusions” page carefully before making a financial decision.