The Temptation of the “Cheap” Premium

If you have been shopping for pet insurance for an English Bulldog, Frenchie, or Pug, you have probably been hit with staggering quotes. When comprehensive coverage costs $150 to $250 a month, a little box that says “Accident-Only Coverage for $15/month!” looks incredibly tempting.

I see owners make this financial pivot every single day. They look at their healthy, playful puppy, assume they only need coverage in case the dog gets hit by a car or eats a sock, and they buy the cheap policy.

Two years later, their dog develops Brachycephalic Obstructive Airway Syndrome (BOAS) or slips a spinal disc. The vet hands them a $6,000 estimate. They file a claim with their “Accident-Only” provider.

The result? A 100% denial.

Let’s break down exactly how insurance underwriters legally define an “accident” versus an “illness,” why this distinction is utterly lethal for flat-faced breeds, and the one specific scenario where buying an accident-only plan is actually a genius move.

The Fatal Flaw: Genetics Are Not “Accidents”

To understand why accident-only plans are so dangerous for brachycephalic dogs, you must understand how insurers classify risk.

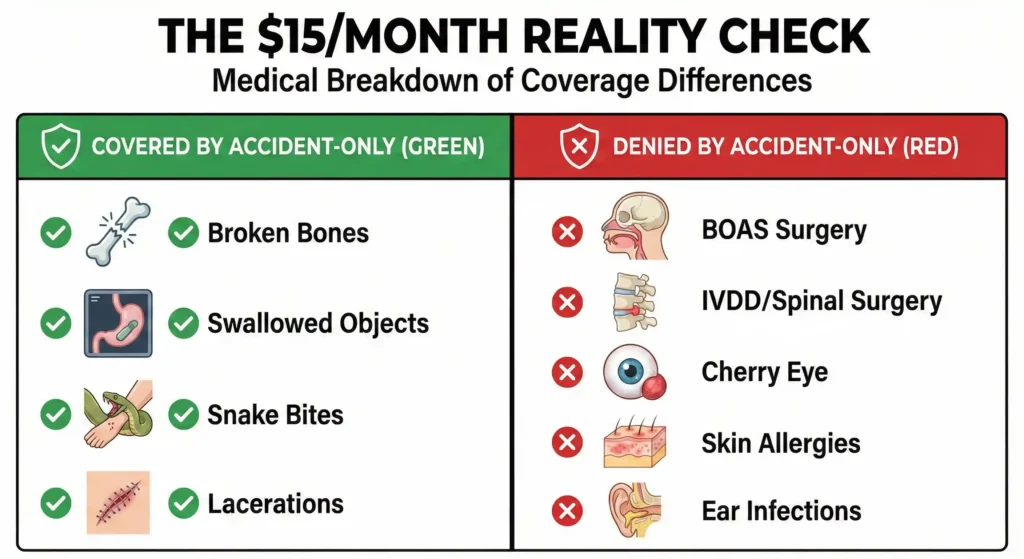

An accident is defined as a sudden, unforeseen physical trauma. If your dog breaks a leg jumping off the couch, gets bitten by a stray dog, or swallows a tennis ball, that is an accident.

An illness is defined as any sickness, disease, or genetic condition that develops internally.

Here is the brutal reality: the American Veterinary Medical Association (AVMA) clearly categorizes hereditary and congenital defects as illnesses. Because Frenchies and Pugs are selectively bred to have flat faces, their breathing issues are a genetic illness.

If your Frenchie chokes because a piece of a toy is lodged in their windpipe (an accident), the $15/month plan pays for the emergency extraction. If your Frenchie chokes because their elongated soft palate collapses into their windpipe due to BOAS (an illness), the plan pays absolutely nothing.

The same applies to their notoriously fragile spines. If a Bulldog develops Intervertebral Disc Disease (IVDD) and becomes paralyzed—a common occurrence that costs $8,000 to fix surgically—accident-only plans will instantly deny the claim, classifying the spinal degeneration as a chronic disease, not a sudden physical trauma.

The Gray Area: Is Heatstroke an Accident?

This is the most highly contested insurance battleground for flat-faced breeds.

If you leave a normal dog in a hot environment and they suffer heat exhaustion, most insurers classify this as an unexpected physical injury (an accident).

However, because the American College of Veterinary Surgeons defines brachycephalic airway syndrome as a severe anatomical impairment that directly limits a dog’s ability to cool themselves, insurance adjusters love to play dirty here.

If your French Bulldog collapses on a mild 75-degree day and you file an accident-only claim, the adjuster will likely pull the vet notes. If the vet mentions that the dog’s narrow nostrils (stenotic nares) contributed to the heatstroke, the insurer will argue that an underlying illness caused the emergency, effectively voiding your accident coverage. You are left paying the $4,000 ICU bill alone.

When Does an Accident-Only Plan Actually Make Sense?

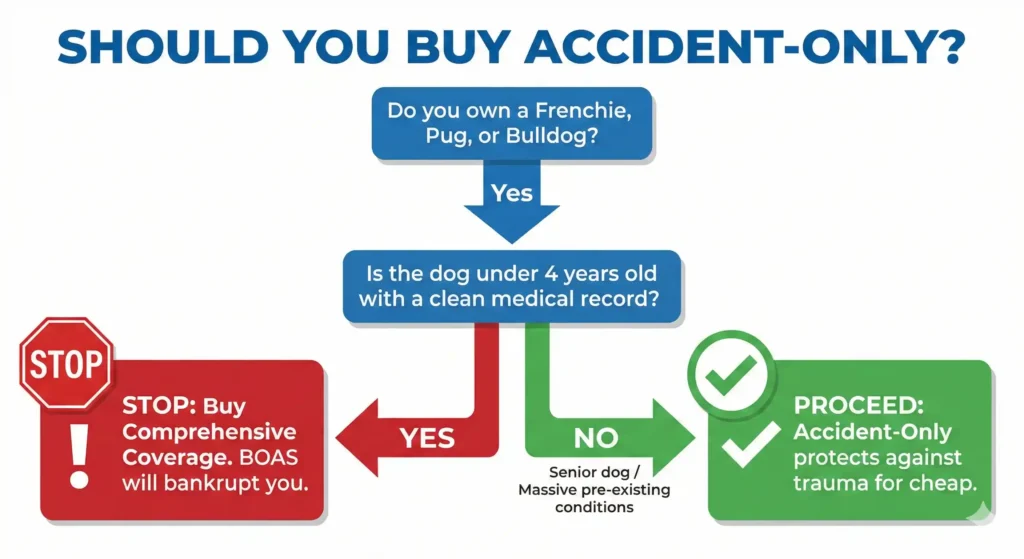

I am incredibly tough on these policies, but I do not hate them. There is one specific scenario where an accident-only plan is the smartest financial decision you can make.

The “Uninsurable Senior” Scenario.

Imagine you rescue a 6-year-old English Bulldog. You take them to the vet, and their medical record is a disaster. They already have documented BOAS, severe hip dysplasia, chronic ear infections, and arthritis.

If you try to buy a comprehensive accident and illness policy for this dog, the insurer is going to quote you $300 a month, and they are going to permanently exclude the airway, the hips, the ears, and the joints as “pre-existing conditions.” You would be paying $3,600 a year for a policy that covers almost nothing.

In this exact scenario, you should buy a $15/month Accident-Only plan from a top-tier provider like Spot or Embrace.

Why? Because accidents are never pre-existing. It does not matter how sick your senior Bulldog is; if they tear an ACL, get hit by a car, or swallow a bone, that $15/month policy will step in and cover the $5,000 emergency trauma bill. It acts as a cheap, catastrophic safety net when comprehensive coverage is no longer mathematically viable.

My Final Verdict

Do not buy an accident-only policy for a Brachycephalic puppy to save a few bucks. It is a terrifying gamble.

The entire reason you insure a flat-faced breed is to protect yourself from the massive, genetic, systemic failures that these dogs are statistically guaranteed to face. An accident-only policy strips away 90% of the coverage you actually need.

Pay the higher premium for a comprehensive plan when they are 8 weeks old, lock in the coverage before their medical record gets dirty, and sleep peacefully knowing that whether they eat a sock or need airway surgery, your bank account is protected.

Frequently Asked Questions (FAQs)

-

Can I upgrade my accident-only plan to a comprehensive plan later?

Yes, but it is highly risky. If you have an accident-only plan for the first two years of your dog’s life, and then upgrade to an illness plan, the insurer treats it as a brand-new policy. This means any illness symptoms (like snoring or skin allergies) your dog showed during those first two years will now be considered pre-existing and permanently excluded from the new coverage.

-

Do accident-only plans cover tooth extractions?

It depends entirely on the cause. If your dog fractures a healthy tooth while aggressively chewing on a hard antler bone, that is an accident and is usually covered. If the tooth has to be extracted because of periodontal disease or genetic rotting (common in crowded Bulldog mouths), that is an illness and will be strictly denied.

-

Are prescription medications covered under an accident plan?

Only if the medication is explicitly prescribed to treat the physical trauma. If your dog is prescribed painkillers and antibiotics for a severe laceration, it is covered. If they are prescribed Apoquel for chronic skin allergies, you pay 100% out of pocket.

YMYL & Financial Disclaimer: The information provided on Flat Face Insurance is for educational and consumer advocacy purposes based on my independent analysis of 2026 US pet insurance underwriting guidelines. I am not a licensed veterinarian or an insurance agent. Pet insurance policy definitions of “accidents” versus “illnesses” vary strictly by state and provider. Always request a full sample policy document from the insurer and read the “Exclusions” page meticulously before making a financial decision.