The “Mirror” Rule You Didn’t Know About

Imagine this: Your Frenchie, Bruno, had a minor “Cherry Eye” surgery on his left eye when he was a puppy, before you bought insurance. It cost $500, and you paid cash. No big deal, right?

Two years later, you have insurance. Suddenly, his right eye develops Cherry Eye. You file a claim, expecting coverage.

The result? DENIED.

Why? Because of the “Bilateral Exclusion” Clause.

To an insurance company, your dog doesn’t have two eyes. He has “one set of eyes.” If one side was sick before the policy started, the other side is automatically considered a “pre-existing condition”—even if it was perfectly healthy at the time.

For flat-faced breeds, this clause is a financial landmine. Here is how to navigate it.

What Exactly is a “Bilateral Condition”?

In plain English: Bilateral = Both Sides.

Insurance providers group body parts that come in pairs. If your dog shows signs of an issue on the left side, the insurer assumes the right side is a ticking time bomb due to genetics.

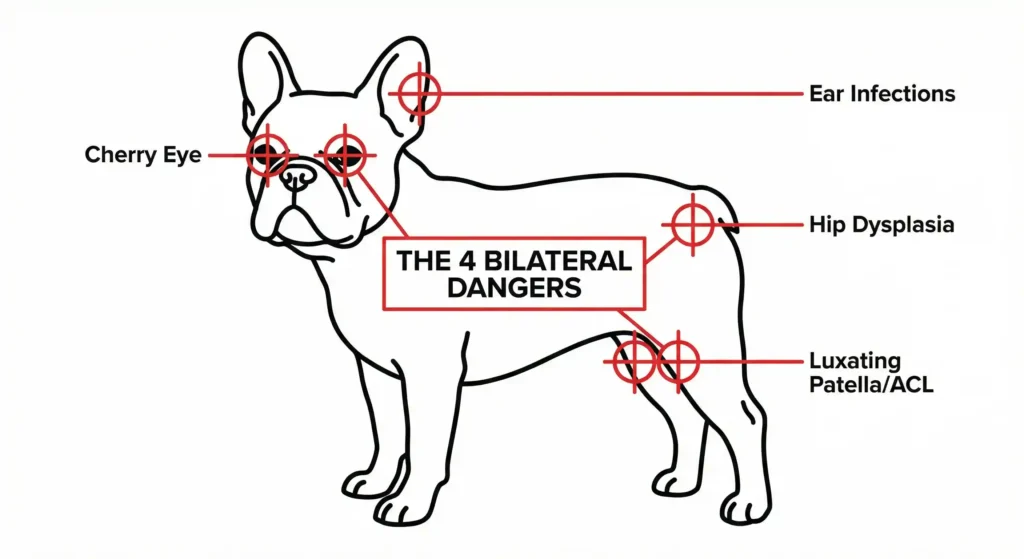

The “Big 4” Bilateral Conditions for Flat Faces:

If your dog had any record of these on one side before your policy waiting period ended, the other side is likely excluded for life:

- Cherry Eye: Extremely common in Bulldogs and Boston Terriers.

- Cruciate Ligament (ACL/CCL) Tears: The knee injury that costs $3,000+ to fix.

- Hip Dysplasia: Common in heavier English Bulldogs.

- Luxating Patella: Moving kneecaps, common in smaller Frenchies.

Warning: Some insurers even apply this to Stenotic Nares (Nostrils). If one nostril was noted as “tight” in a puppy exam, they might deny a future BOAS surgery claiming the entire respiratory system was pre-existing.

The “Trap” vs. The “Safe” Policy

Not all insurers use this brutal rule. Some have “Curable” clauses, while others are strict.

Comparison: How Different Policies Handle the “Other Side”

| Feature | ❌ The “Trap” Policy | ✅ The “Flat-Face Friendly” Policy |

| The Rule | “If Condition X exists on the Left, the Right is excluded forever.” | “Each side is treated as a separate incident (rare) OR excludable only for 12 months.” |

| Cruciate Ligament | Strict exclusion. If Left knee failed in 2023, Right knee is never covered. | May offer coverage for the other knee if no issues arise for 12-24 months. |

| Cherry Eye | almost always excluded bilaterally. | Excluded, but some top-tier plans make exceptions for “Curable” conditions. |

| Appeal Process | Very difficult to overturn. | Allows a “Orthopedic Exam” by a vet to prove the other side is healthy. |

Case Study: The $4,500 Mistake (Meet “Bella”)

Let’s look at a real-world scenario to show how dangerous this clause is.

The Dog: Bella, a 2-year-old French Bulldog. The History: Before getting insurance, Bella visited a vet for “mild limping” on her left back leg. The vet noted “possible early Luxating Patella” but prescribed rest. No surgery was done. The Insurance: Two months later, the owner bought a policy with a standard provider. The Incident: At age 3, Bella’s right back leg blew out (ACL tear). The owner filed a claim for the $4,500 surgery.

The Outcome: DENIED. The insurer pulled the old records. Even though the left leg was the issue back then, the policy stated that knee issues are Bilateral. Because the left leg showed signs before the policy started, the right leg was excluded automatically.

The Lesson: If Bella’s owner had chosen a provider with a “Curable Pre-Existing Condition” clause or gotten a “Bilateral Waiver” from an orthopedic vet beforehand, they would have been covered.

How to Protect Your Wallet (Action Plan)

If you are shopping for insurance or already have it, do these three things immediately:

1. Check Your “Medical History Review”

Most insurers offer a “Medical History Review” within the first 30 days of a policy. Do this. Send them your vet records and ask specifically: “Is my dog’s right knee covered, or is it excluded because of the limp he had last year?” Get the answer in writing now, not when you are standing at the surgery check-in desk.

2. Look for “Curable” Clauses

Some modern insurers (like Spot, ASPCA, or Pumpkin) differentiate between “Incurable” (like Hip Dysplasia) and “Curable” conditions. If your dog had an issue that was treated and hasn’t returned for 180 days or 1 year, they might reinstate coverage.

3. The “Orthopedic Waiver”

For knee issues, some companies allow you to fill out a “Cruciate Ligament Waiver Form.” If your vet certifies that the other knee is 100% stable, the insurer may waive the waiting period or exclusion.

Conclusion: Read the Fine Print, Save the Dog

The Bilateral Exclusion is the industry’s dirty little secret. For Frenchie owners, where joint and eye issues are almost guaranteed, ignorance is expensive.

Don’t just buy the cheapest premium you see on Google. Buy the policy that understands that a left-eye problem doesn’t mean the right eye is doomed.

Need help decoding your policy?

At Flat Face Insurance, we specialize in finding plans that don’t punish your dog for being a breed.

Frequently Asked Questions (FAQs)

-

Is Cherry Eye always considered bilateral?

In 90% of policies, yes. If your dog had Cherry Eye on the left eye before insurance, the right eye is excluded. However, if both eyes were healthy when you bought the policy, both are covered.

-

Can I switch insurance if my dog already has a bilateral exclusion?

It is difficult. The new company will also see the pre-existing condition on the first side and likely apply the same exclusion. Your best bet is to find a company with a “Curable Condition” clause if the issue was resolved long ago.

-

Does BOAS surgery count as bilateral?

Technically, yes (you have two nostrils), but it is usually treated as one single condition: “Brachycephalic Syndrome.” If any part of the airway was compromised before insurance, the entire surgery is usually denied