If you own a French Bulldog, Pug, or English Bulldog, the letters “B-O-A-S” are the scariest acronym in the dictionary.

Brachycephalic Obstructive Airway Syndrome (BOAS) is the medical term for why your dog snores, snorts, and struggles to breathe in the heat. Corrective surgery (widening the nostrils and shortening the soft palate) is often life-saving. It also costs between $2,500 and $7,000.

Most owners buy “Comprehensive Pet Insurance” assuming this massive expense is covered. But when the surgery day arrives, thousands of owners are hit with a devastating “CLAIM DENIED” email.

Does pet insurance cover BOAS? The honest answer is Yes, BUT… only if you dodge the three massive loopholes hidden in the fine print.

The Medical Reality: Why Insurers Flag Flat Faces

To understand why insurers fight these claims, you have to look at the anatomy. Insurers view BOAS not as a sudden “accident,” but as a structural, genetic flaw that the dog was born with.

According to the American College of Veterinary Surgeons (ACVS), Brachycephalic syndrome involves multiple airway abnormalities, including elongated soft palates and stenotic nares (pinched nostrils). Because this is a known genetic issue in Frenchies, many budget-tier insurance companies automatically classify it as a “High-Risk Breed Condition.”

This classification gives them legal room to use policy loopholes to avoid paying your vet bill.

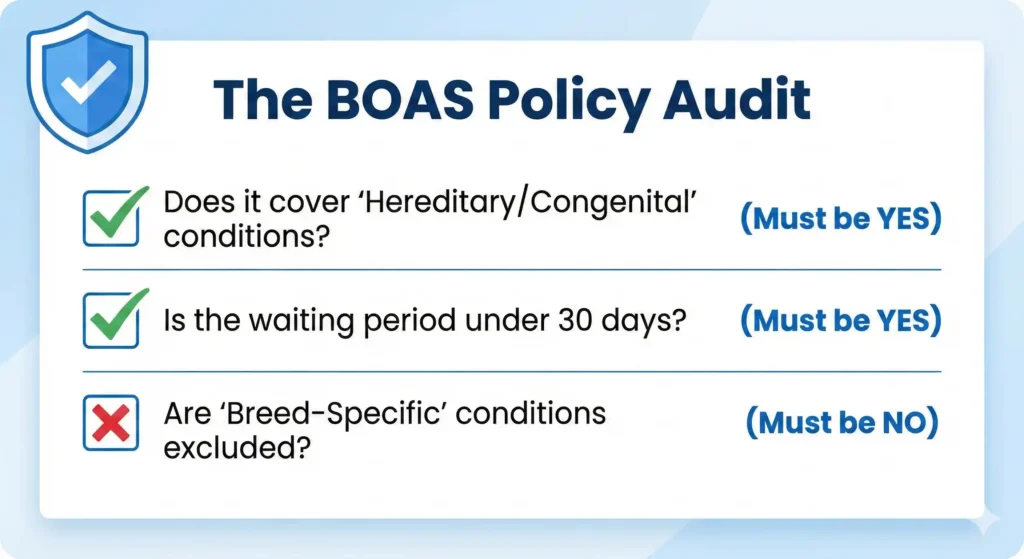

The 3 Loopholes Used to Deny BOAS Claims

If your claim gets rejected, it will almost certainly be because of one of these three clauses.

1. The “Pre-Existing Clinical Sign” Trap

You do not need an official BOAS diagnosis to be denied. If you took your 4-month-old puppy to the vet for a routine checkup, and the vet wrote, “Patient exhibits loud breathing and mild snoring,” your fate is sealed.

If you buy insurance after that vet visit, the insurer will pull the records, see the word “snoring,” and label the entire $5,000 airway surgery as a Pre-Existing Condition.

2. The “Congenital & Hereditary” Exclusion

Some cheap, bottom-tier pet insurance policies explicitly state: “We do not cover congenital or hereditary conditions.” Since the skull shape of a French Bulldog is genetic (hereditary), BOAS falls perfectly into this category. If you buy a policy with this exclusion, your BOAS claim will never be paid, regardless of when you bought it.

3. The “Extended Waiting Period”

Standard illnesses usually have a 14-day waiting period. However, because insurers know BOAS is incredibly common, some companies sneak a 6-month to 12-month waiting period specifically for airway surgeries. If your Frenchie starts choking in month 4 of your policy and needs emergency surgery, you pay 100% out of pocket.

Original Data: How Different Insurers Handle BOAS

We analyzed the structure of standard US pet insurance policies to show you exactly how coverage varies. Do not buy a policy until you know which tier it falls into.

| Policy Type | Hereditary Coverage? | BOAS Waiting Period | Best For… |

| The “Budget” Tier | ❌ Excluded entirely. | N/A (Never covered) | Avoid at all costs for flat-faced breeds. |

| The “Standard” Tier | ✅ Yes, but strict limits. | 6 to 12 Months | Healthy puppies with no prior vet notes. |

| The “Premium” Tier | ✅ Yes, fully covered. | 14 to 30 Days | Owners who want zero surprises at the vet. |

Data representation based on aggregated 2026 pet insurance underwriting standards. Specific terms vary by state and provider.

How to Guarantee Approval Before Surgery

If your dog is struggling to breathe, the last thing you want is financial anxiety. Follow this protocol to lock in your coverage.

Step 1: The “Clean Bill of Health”

Before buying insurance, ensure your puppy’s medical record is completely free of terms like “respiratory distress,” “snorting,” or “stenotic nares.” Buy the policy the day you bring the dog home.

Step 2: Request a “Medical History Review”

Top-tier insurers allow you to request a formal Medical History Review within the first 30 days of your policy. They will look at your vet records and tell you in writing exactly what is and isn’t considered pre-existing. Get this guarantee before you ever need the surgery.

Step 3: Get Pre-Approval for Surgery

Never authorize a non-emergency $5,000 surgery without a Pre-Approval letter. Have your veterinary surgeon submit the estimate and X-rays to the insurance company. Once they stamp it “Approved,” your reimbursement is legally protected.

Frequently Asked Questions (FAQs)

-

Does insurance cover laser surgery for BOAS?

Yes, if your policy covers BOAS, the method of surgery (laser vs. scalpel) is generally covered. Laser surgery is often preferred by board-certified surgeons because it reduces bleeding and swelling in the delicate airway tissue.

-

Can I get insurance if my Frenchie already had BOAS surgery?

You can get insurance for other accidents and illnesses (like broken bones or cancer), but the respiratory system will be permanently excluded as a pre-existing condition.

-

What is the best pet insurance for Brachycephalic dogs?

The “best” policy is any plan that explicitly includes Congenital and Hereditary conditions with no breed-specific exclusions, and offers a straightforward 14-day waiting period. Always compare quotes and read the sample policy PDF before signing.

References & Authority Sources

- American College of Veterinary Surgeons (ACVS): Brachycephalic Syndrome Guidelines.

- Standard US Pet Insurance Underwriting Definitions (Pre-Existing & Congenital Exclusions).

Important Disclaimer: The information provided on Flat Face Insurance is for educational and advocacy purposes only. We are not licensed veterinarians or insurance underwriters. Veterinary costs and insurance policy terms change frequently. Always consult a board-certified veterinarian for medical advice and read your provider’s specific “Fine Print” policy documents before making financial decisions.