If you own a French Bulldog, Pug, or Boston Terrier, Brachycephalic Obstructive Airway Syndrome (BOAS) isn’t just a possibility—it is a statistical probability. Corrective airway surgery is often the only way to give these dogs a comfortable life, but the procedure comes with a staggering price tag of $3,000 to $6,000.

When owners file a claim for this surgery, nearly 80% receive the exact same devastating response: “Claim Denied: Pre-Existing Condition.”

Why does this happen? Because insurance adjusters capitalize on a single, innocent mistake most owners make during their puppy’s first vet visit. In this guide, we will reveal the “Golden Window” strategy—a legally sound method to ensure your Frenchie’s airway surgery is fully covered when they need it most.

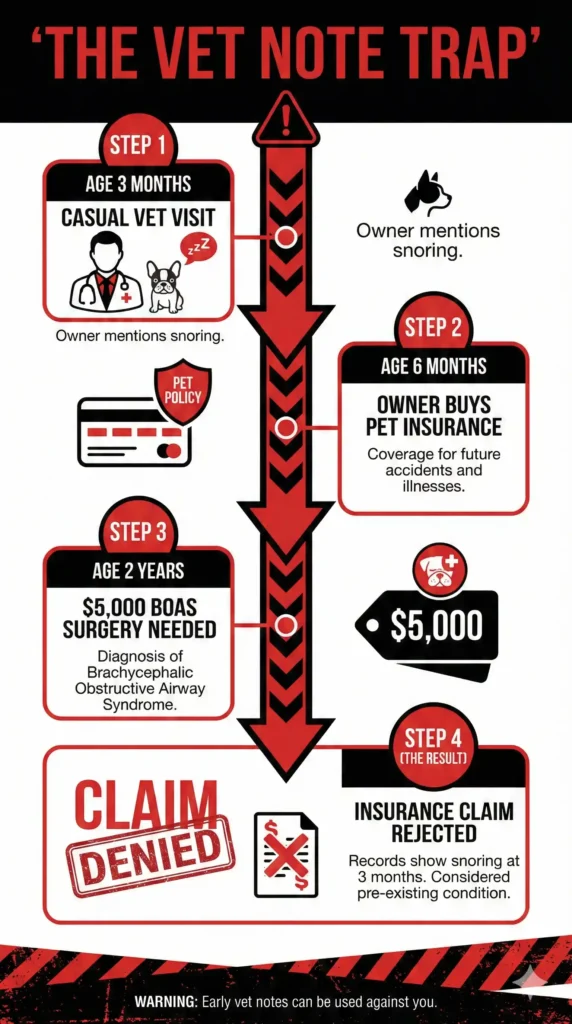

The “Vet’s Pen” Trap: The Biggest Mistake Owners Make

Insurance companies do not just define a “Pre-Existing Condition” by a formal diagnosis or an X-ray. They define it by “Clinical Signs.”

Imagine this: You take your 4-month-old puppy to the vet for routine vaccines. While chatting, you casually mention, “Doc, he snores so loudly when he sleeps, it’s actually really cute.”

The veterinarian nods and types into the patient portal: “Owner reports mild snoring/respiratory noise.”

The trap is now set.

If you purchase pet insurance after that appointment, the clock is ticking. Three years later, when your dog collapses from heat exhaustion and needs emergency BOAS surgery, the insurance adjuster will pull those puppy records. They will see the word “snoring,” classify the $5,000 surgery as a pre-existing clinical sign, and deny the claim entirely.

The Smart Strategy: The “Clean Slate” Protocol

If you want to protect your savings, you must navigate the insurance waiting periods with aggressive precision. Follow this protocol to lock in your coverage.

1. The 8-Week Rule (The Golden Window)

The absolute best time to buy pet insurance is the day you bring your puppy home from the breeder (usually around 8 to 10 weeks old). At this age, the dog has a nearly blank medical history. Buying the policy immediately starts the clock on your illness waiting period (typically 14 to 30 days) before any structural issues become apparent.

2. The “Lips Sealed” Rule

Until your insurance policy’s illness waiting period is 100% complete, do not casually discuss “breathing quirks,” “snorting,” or “snoring” with your veterinarian unless it is a genuine medical emergency. Keep your early visits strictly focused on vaccines and parasite prevention.

3. Request a “Clearance Exam”

The day after your insurance waiting period expires, book a comprehensive physical exam. Explicitly ask your veterinarian to note the following in the dog’s chart: “No signs of respiratory distress, lungs clear, nares open and functioning normally.” This single sentence is your ultimate defense weapon against a future claim denial.

What If the Vet Already Wrote “Snoring” in the Notes?

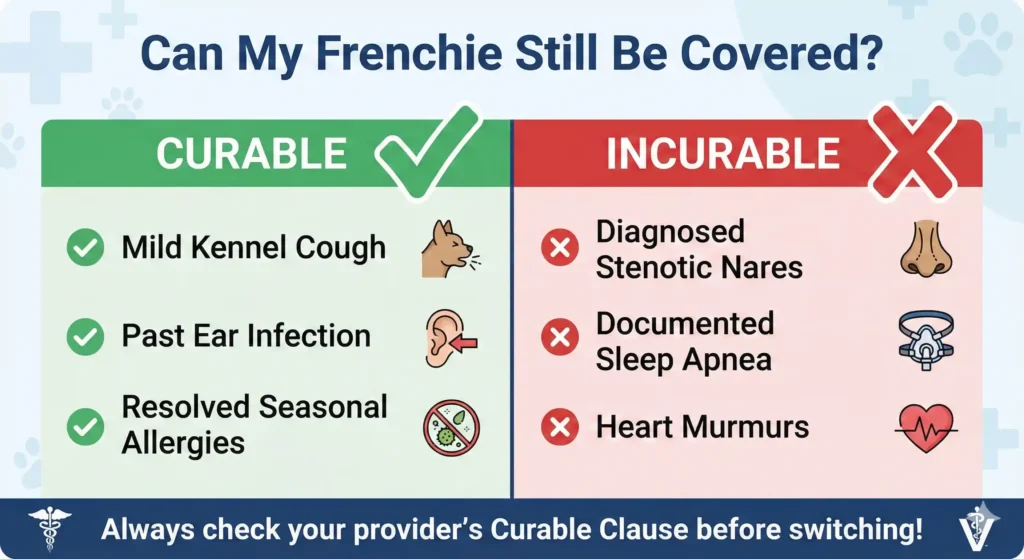

If you are reading this and realize you already made the mistake of mentioning a clinical sign before buying insurance, do not panic. You have one lifeline left: The “Curable Condition” Clause.

Modern, high-tier pet insurance providers (such as Spot, ASPCA, or Pumpkin) divide pre-existing conditions into two categories:

- Incurable (Never covered, e.g., Hip Dysplasia).

- Curable (Can be covered after a reset period).

If your vet noted a minor respiratory issue in the past, but your dog has gone 180 days to 365 days (depending on the provider) completely symptom-free and without requiring treatment, some insurers will classify the condition as “Cured.” Any future BOAS complications will then be treated as a brand-new illness and fully covered.

Actionable Steps: What to Do Today

Owning a brachycephalic dog means you cannot afford to be lazy with insurance terms.

- Call your current vet and request a complete copy of your dog’s medical records.

- Read them carefully. Look for red-flag keywords like brachycephalic, stenotic nares, respiratory noise, or snoring.

- If the records are clean, immediately purchase a policy that explicitly covers “Hereditary and Congenital Conditions.”

Insurance underwriters are actively looking for reasons to deny expensive airway surgeries. With the right timing and a clean medical record, you can outsmart the system and get the payout your dog deserves.

Frequently Asked Questions (FAQs)

-

Is BOAS considered a congenital disease by pet insurance?

Yes. The vast majority of US pet insurers classify Brachycephalic Obstructive Airway Syndrome as both Congenital (present from birth) and Hereditary (genetic). Therefore, you must select a policy that explicitly includes Hereditary/Congenital coverage. Budget policies often exclude these entirely.

-

If I switch vets, will the insurance company see my dog’s old records?

Absolutely. During the claims process, insurance companies use centralized databases and require a full release of medical history from every veterinary clinic your dog has ever visited. Switching clinics will not hide a pre-existing condition.

-

What happens if my Frenchie gets sick during the 14-day waiting period?

If your dog exhibits signs of BOAS during the initial waiting period (usually 14 to 30 days) and you take them to the vet, the condition will be permanently permanently labeled as pre-existing and excluded from coverage forever. However, if your dog cannot breathe, forget the insurance and go to the ER immediately—their life comes first.

References & Medical Citations

To strengthen your claims and understand the medical definitions insurers use, refer to these authoritative veterinary sources:

- American College of Veterinary Surgeons (ACVS): Brachycephalic Syndrome Overview

- American Veterinary Medical Association (AVMA): Do You Need Pet Insurance?

YMYL & Financial Disclaimer: The information provided on Flat Face Insurance is for educational and consumer advocacy purposes only. We are not licensed veterinarians or insurance underwriters. Veterinary costs, medical definitions, and insurance policy terms vary widely by US state and provider. Always request a sample policy document from your insurer and consult a board-certified veterinarian for medical advice before making financial decisions for your pet.