The Ticking Clock Nobody Warns You About

When you realize your French Bulldog or Pug is struggling to breathe, your first instinct is to panic. Your second instinct is to immediately go online and buy pet insurance so you aren’t stuck with a $6,000 surgical bill.

But when I talk to devastated pet owners whose claims were denied, they all fell into the exact same trap: The Waiting Period. You cannot buy pet insurance on a Tuesday and book a Brachycephalic Obstructive Airway Syndrome (BOAS) surgery on a Wednesday. Every single pet insurance company in the United States legally enforces a “Waiting Period”—a strict block of time between the day you pay your first premium and the day your coverage actually begins.

If your dog visits the vet or shows any clinical signs of breathing issues during this window, the condition is permanently flagged as pre-existing, and you will never get a dime.

Let’s break down how to legally navigate this system, which companies force you to wait the longest, and the secret “loophole” to bypass the wait entirely.

Illness vs. Hereditary: The Sneaky Policy Distinction

To beat the waiting period, you first need to understand how insurance underwriters classify your dog’s breathing problems.

Most standard pet insurance policies have a standard 14-day waiting period for general illnesses (like an ear infection or a stomach bug).

However, because BOAS is caused by the genetic shape of your dog’s skull, many insurers classify it as a “Hereditary or Congenital Condition.” This is where they trap you. While the standard illness wait is 14 days, some budget-tier insurers will sneak a 6-month or even 12-month waiting period into the fine print specifically for hereditary conditions.

According to the official consumer guidelines published by the American Veterinary Medical Association (AVMA), it is entirely your responsibility to read the exclusions list and verify the exact waiting period for breed-specific genetic conditions before you hand over your credit card.

The 2026 Waiting Period Cheat Sheet

I analyzed the policy documents of the top US pet insurance providers specifically looking at how long a French Bulldog or Pug owner has to wait before their BOAS coverage becomes active.

| Pet Insurance Provider | General Illness Wait | Hereditary / BOAS Wait | My Verdict for Flat Faces |

|---|---|---|---|

| Spot / ASPCA | 14 Days | 14 Days | Excellent. No extended hereditary wait. |

| Lemonade | 14 Days | 14 Days (varies by state) | Good, but double-check your state’s specific PDF. |

| Healthy Paws | 15 Days | 15 Days | Solid choice, but watch out for their annual deductible. |

| Trupanion | 30 Days | 30 Days | Longer standard wait, but has a secret loophole (see below). |

| Budget/Discount Plans | 14 Days | 6 to 12 Months | Avoid. You cannot risk waiting a year for airway coverage. |

The “Exam Day Offer” Loophole

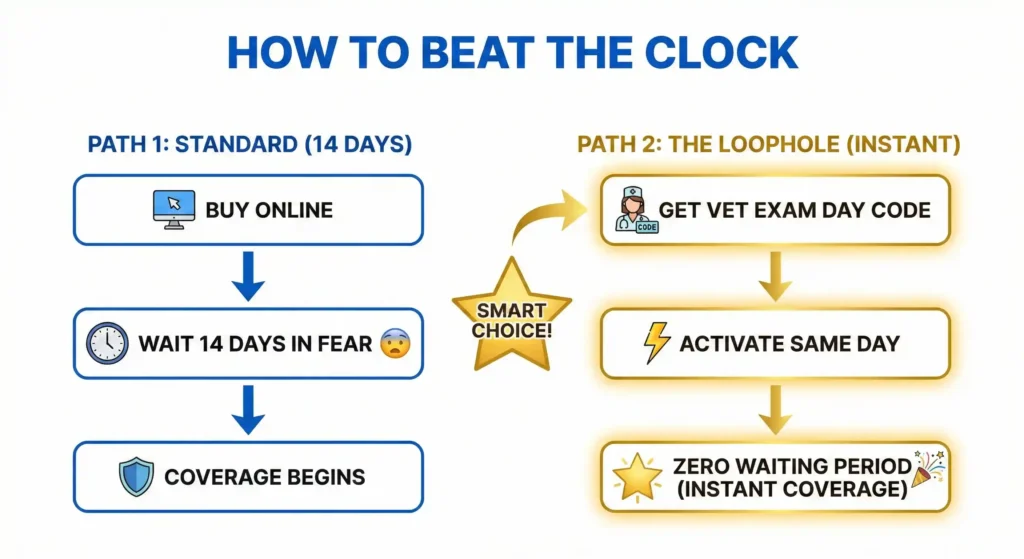

If you look at the table above, you will notice Trupanion has a long 30-day waiting period. However, they also offer the single best loophole in the entire pet insurance industry for new puppies.

It is called the Exam Day Offer (sometimes referred to as a Vet Code).

If you take your perfectly healthy puppy to a Trupanion-partnered veterinarian for a standard wellness check, the vet can give you a special activation code. If you use that code to activate your policy within 24 hours of the exam, Trupanion completely waives the waiting period. Your coverage begins instantly on Day 1.

If you are picking up an 8-week-old Bulldog puppy, I highly recommend finding a vet who offers this code. Locking in immediate coverage before the puppy has a chance to develop any breathing habits is the ultimate financial shield.

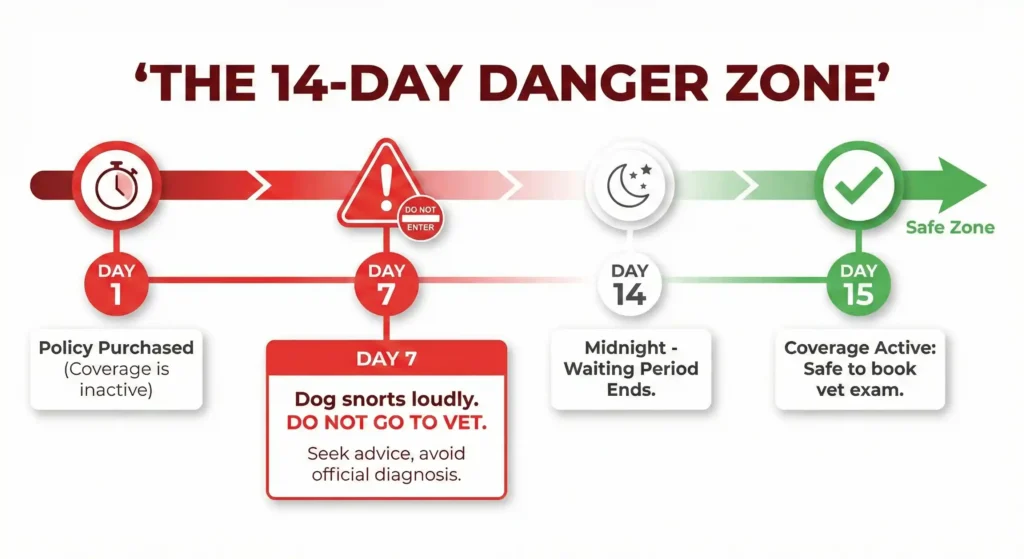

What Happens if Your Dog Snorts on Day 13?

This is the nightmare scenario. You buy a policy with a 14-day waiting period. On Day 13, your Frenchie overheats in the yard, starts gagging, and you rush them to the emergency room.

The vet treats them and writes “suspected BOAS / elongated soft palate” in the medical notes.

Because this happened before the clock struck midnight on Day 14, the insurance company will legally classify BOAS as a pre-existing condition. They will not pay for the emergency visit, and worse, they will permanently exclude any future airway surgeries for the rest of your dog’s life.

This is why I constantly tell owners: Do not wait for the snore. You must buy pet insurance the very first day you bring your dog home, while they are completely healthy, so you can safely burn through that 14-day waiting period without any vet visits.

Frequently Asked Questions (FAQs)

-

Can I buy pet insurance after my vet recommends BOAS surgery?

You can buy the insurance, but it will be absolutely useless for the surgery. Any condition recommended, diagnosed, or showing clinical signs before the waiting period is over will be denied as a pre-existing condition. Insurance is for “what ifs,” not “what already happened.”

-

Do waiting periods apply to wellness plans and vaccines?

Generally, no. If you add a “Preventative” or “Wellness” rider to your policy to cover vaccines, flea/tick medication, and microchipping, that specific coverage usually begins within 24 hours. The 14-day wait only applies to unexpected illnesses and accidents.

-

What is the fastest pet insurance to get active?

Without a specific vet activation code (like Trupanion’s), the fastest standard waiting periods for illnesses in the US are typically 14 days, offered by companies like Spot, ASPCA, Lemonade, and Embrace. Always verify that they don’t have a separate, longer waiting period explicitly for hereditary conditions.

YMYL & Financial Disclaimer: The information provided on Flat Face Insurance is for educational and consumer advocacy purposes based on my independent research. I am not a licensed veterinarian or an insurance broker. Waiting periods and policy rules are strictly governed by state laws and change frequently. Always request a full sample policy document from the provider and read the “Waiting Periods” and “Exclusions” pages carefully before making a financial decision.